Yearly income calculator after taxes

See where that hard-earned money goes - Federal Income Tax Social Security and. The easiest way to calculate annual income is to multiply your hourly wage by 2000.

Income Tax Formula Excel University

See How Easy It Is.

. On the new W-4 you can no longer claim allowances as it instead features a five. Ad See the Paycheck Tools your competitors are already using - Start Now. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator.

Ad Discover Helpful Information And Resources On Taxes From AARP. Youll then get a breakdown of your total tax liability and take-home pay. That means that your net pay will be 40568 per year or 3381 per month.

That means that your net pay will be 43041 per year or 3587 per month. Try out the take-home calculator choose the 202223 tax year and see how it affects. How Your Paycheck Works.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Over the last few years withholding calculations and the Form W-4 went through a number of adjustments. Thats because someone who works full-time for a year would work around 2000 hours per year.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076. GetApp has the Tools you need to stay ahead of the competition. It can also be used to help fill steps 3.

This places New Zealand on the 22nd place in the. Income qnumber required This is required for the link to work. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. GetApp has the Tools you need to stay ahead of the competition. It can be any hourly weekly or.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Your average tax rate is. After deducting taxes the average single worker in Sydney takes home 53811 yearly or 4484 per month.

That means that your net pay will be 45925 per year or 3827 per month. If you make 55000 a year living in the region of New York USA you will be taxed 11959. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Ad See the Paycheck Tools your competitors are already using - Start Now. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. That means that your net pay will be 37957 per year or 3163 per month.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. The online tax calculator makes filing your annual tax return that little bit easier as well as being a great tool for comparing salary after tax calculations when looking for a new.

Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Rates remain high in Melbourne where median weekly earnings top 1200.

But calculating your weekly take-home. The average monthly net salary in New Zealand NZ is around 3 117 NZD with a minimum income of 2 157 NZD per month. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Youll then see an estimate of. Yes you can use specially formatted urls to automatically apply variables and auto-calculate.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Your average tax rate is. Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate.

Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

How To Calculate Income Tax In Excel

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Paycheck Calculator Take Home Pay Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Annual Income Calculator

Ontario Income Tax Calculator Wowa Ca

Paycheck Calculator Take Home Pay Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Avanti Gross Salary Calculator

What Are Earnings After Tax Bdc Ca

Income Tax Formula Excel University

Net Profit Margin Calculator Bdc Ca

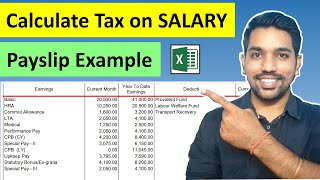

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

How To Calculate Income Tax In Excel